by Carol Lawson Esq | Jan 9, 2020 | Bankruptcy

Chapter 7 Bankruptcy is straight / liquidation personal bankruptcy. A single person or married couple files papers with the Bankruptcy Court asking for immediate protection from their creditors and ultimately for a discharge of debts.

Clearwater Bankruptcy, 28870 U.S. Hwy 19 #361, Hodusa Towers, Clearwater, FL 33761

Phone: (727) 330-1627 email: carollawsonesq@gmail.com

by Carol Lawson Esq | Oct 11, 2019 | Bankruptcy, Consumer Credit, Florida Foreclosures, Foreclosure

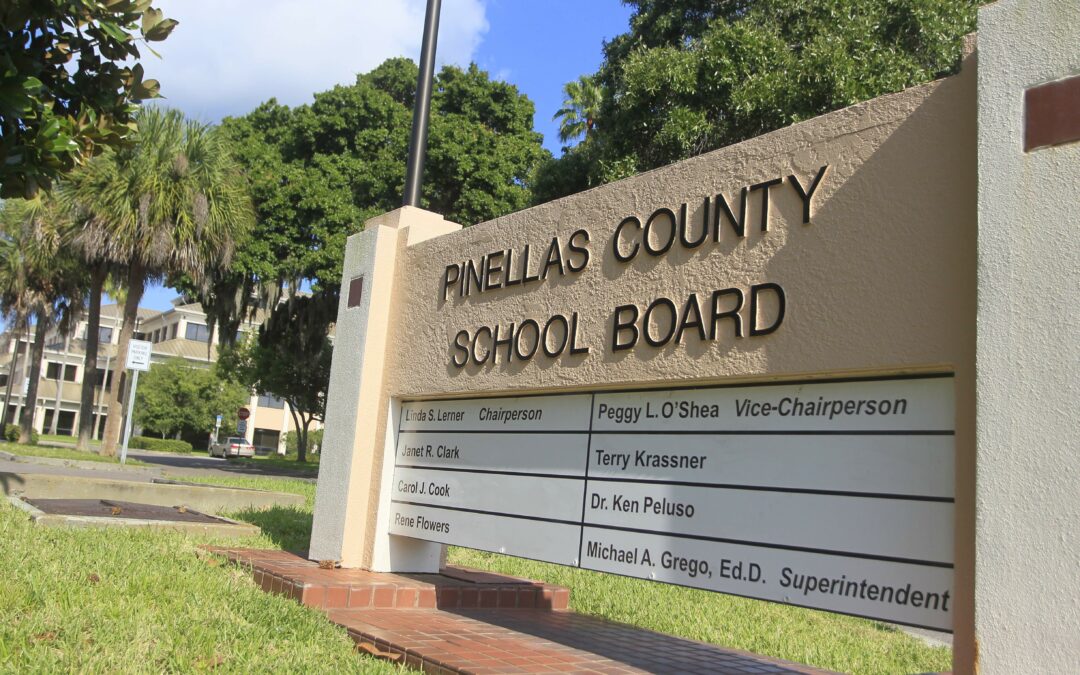

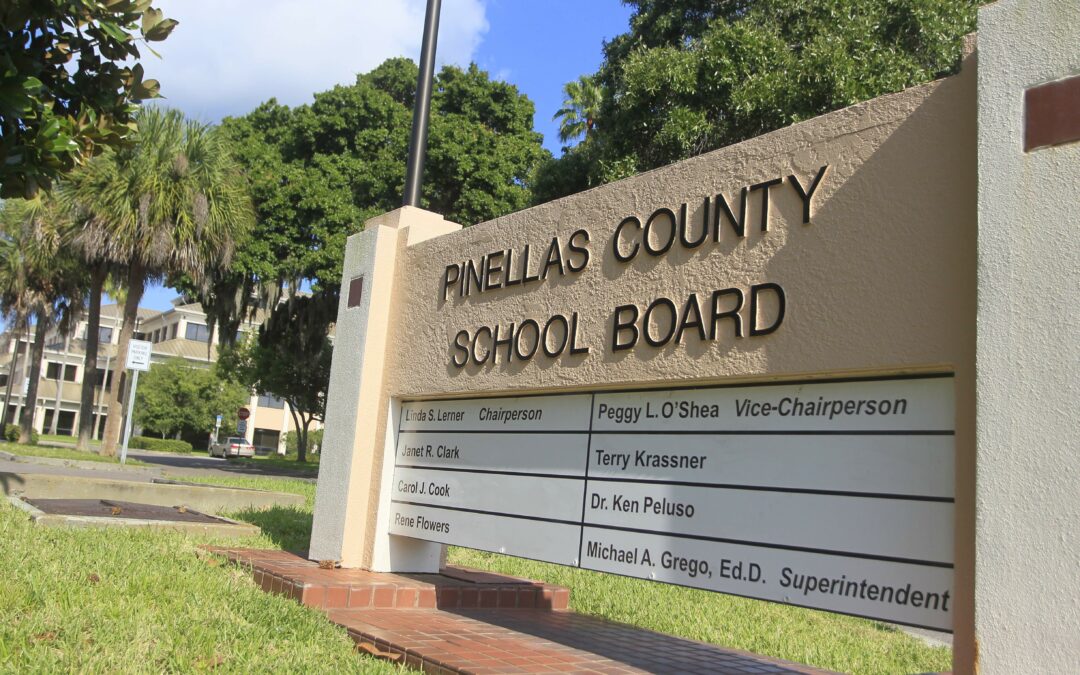

Teachers and staff did you know that you have the MetLife Plan through Hyatt Legal you can

receive - a free trust, will, quitclaim deed, living will, healthcare surrogate, and DPOA

before the end of the year.

If they you my office - Carol Lawson PA- #727-410-2705, not only are after school appointments

available, but you receive a Dementia Directive for free.

Hyatt will also pay the Attorney fees ( no costs) for a Bankruptcy. Our office participates

in this area handling Chapter 7s only. Costs by our office are credit report, personal property

apprassial, and filing fee. You also are responsible for a credit counseling class.

by Carol Lawson Esq | Jun 30, 2019 | Bankruptcy, Consumer Credit, Uncategorized

The Ninth Circuit – U.S. Court of Appeals held that a bank did not willfully violate the automatic stay by placing a temporary administrative pledge on the debtors’ accounts in favor of the bankruptcy trustee.

A copy of the opinion is available at: http://cdn.ca9.uscourts.gov/datastore/opinions/2014/08/26/12-16087.pdf

Wells Fargo, however, recently got slammed by a Federal Judge in NY for their practice of freezing Chapter 7 Debtor accounts nationwide. Bankruptcy Court Judge Cecelia G. Morris. December 2014, awarded the Weidenbenners $25 in damages for a bounced-check charge, plus costs and lawyers fees. In her ruling, the judge blasted Wells Fargo, which was not a creditor in the case, for freezing the money and controlling access to it. Accusing the bank of “grandstanding” about bankruptcy-code compliance. In re Weidenbenner, 521 B.R. 74, 2014 WL 7139994 (Bankr. S.D. N.Y., 2014).

Wells claims that their nationwide policy is only to freeze accounts of debtors with $5000 or more– not true. If you are going to file Chapter 7– move your bank account from Wells Fargo before you file.

Clearwater Bankruptcy, 28870 U.S. Hwy 19 #361, Hodusa Towers, Clearwater, FL 33761,

Phone: (727) 330-1627 email: carollawsonesq@gmail.com

by Carol Lawson Esq | Jun 25, 2019 | Florida Foreclosures, Foreclosure

Locked out

Imagine this: you’re on a two-week vacation. You come back, and find a notice on your door: Entry by unauthorized persons prohibited.

Your key in the lock – it doesn’t fit. You peek through the windows and see that everything you left behind is gone – your furniture, your clothes, your photographs – everything.

You’ve been a victim of your mortgage.

Most mortgages that allows the bank to “protect its interest” in the “security” pledged for the loan – in other words, your home. If the bank, or its inspectors, decide at any point that you’ve “abandoned” the home, they claim the mortgage gives them the right to change the locks, board the windows, drain the pipes, and clean out any trash- your stuff.

Here’s the language most commonly used in many Florida mortgages:

9. Protection of Lender’s Interest in the Property and Rights Under this Security

Instrument. If (a) Borrower fails to perform the covenants and agreements contained in this Security Instrument, (b) there is a legal proceeding that might significantly affect Lender’s interest in the Property and/or rights under this Security Instrument (such as a proceeding in bankruptcy, probate, for condemnation or forfeiture, for enforcement of a lien which may attain priority over this Security Instrument or to enforce laws or regulations), or (c) Borrower has abandoned the Property, then Lender may do and pay for whatever is reasonable or appropriate to protect Lender’s interest in the Property and rights under this Security Instrument, including protecting and/or assessing the value of the Property, and securing and/or repairing the Property.

…

Securing the Property includes, but is not limited to, entering the Property to make repairs, change locks, replace or board up doors and windows, drain water from pipes, eliminate building or other code violations or dangerous conditions, and have utilities turned on or off. Although Lender may take action under this Section 9, Lender does not have to do so and is not under any duty or obligation to do so. It is agreed that Lender incurs no liability for not taking any or all actions authorized under this Section 9.

What does this mean? It means that the bank decides you’ve “abandoned” your home they can come in and take complete possession of your home, without foreclosing or even giving you prior notice.

The police will not help you- they will tell you it is a civil matter to higher an attorney.

Clearwater Bankruptcy, 28870 U.S. Hwy 19 #361, Hodusa Towers, Clearwater, FL 33761,

Phone: (727) 330-1627 email: carollawsonesq@gmail.com

by Carol Lawson Esq | Jun 16, 2019 | Bankruptcy, Consumer Credit

Are debt collectors constantly call your home and send you threatening letters in the mail, it might be time to consider bankruptcy. Clearwater Bankruptcy evaluates your financial situation to determine if bankruptcy is the best option for you. Your Clearwater Bankruptcy Attorney will explain the specifics of bankruptcy law, and help you understand how to rebuild your credit so you can get a fresh start. Don’t live in fear with the phone off the hook – get the information and answers you need. Debt Relief is what we do! Come in for a Free Consolation today!

Clearwater Bankruptcy, 28870 U.S. Hwy 19 #361, Hodusa Towers, Clearwater, FL 33761,

Phone: (727) 330-1627 email: carollawsonesq@gmail.com