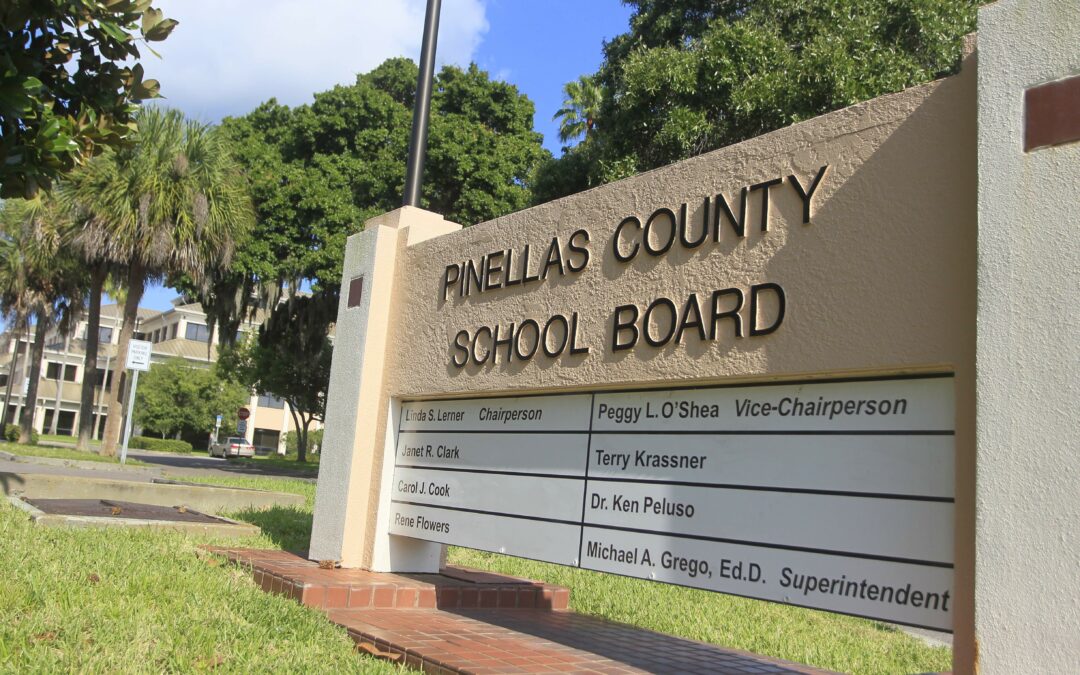

by Carol Lawson Esq | Oct 11, 2019 | Bankruptcy, Consumer Credit, Florida Foreclosures, Foreclosure

Teachers and staff did you know that you have the MetLife Plan through Hyatt Legal you can

receive - a free trust, will, quitclaim deed, living will, healthcare surrogate, and DPOA

before the end of the year.

If they you my office - Carol Lawson PA- #727-410-2705, not only are after school appointments

available, but you receive a Dementia Directive for free.

Hyatt will also pay the Attorney fees ( no costs) for a Bankruptcy. Our office participates

in this area handling Chapter 7s only. Costs by our office are credit report, personal property

apprassial, and filing fee. You also are responsible for a credit counseling class.

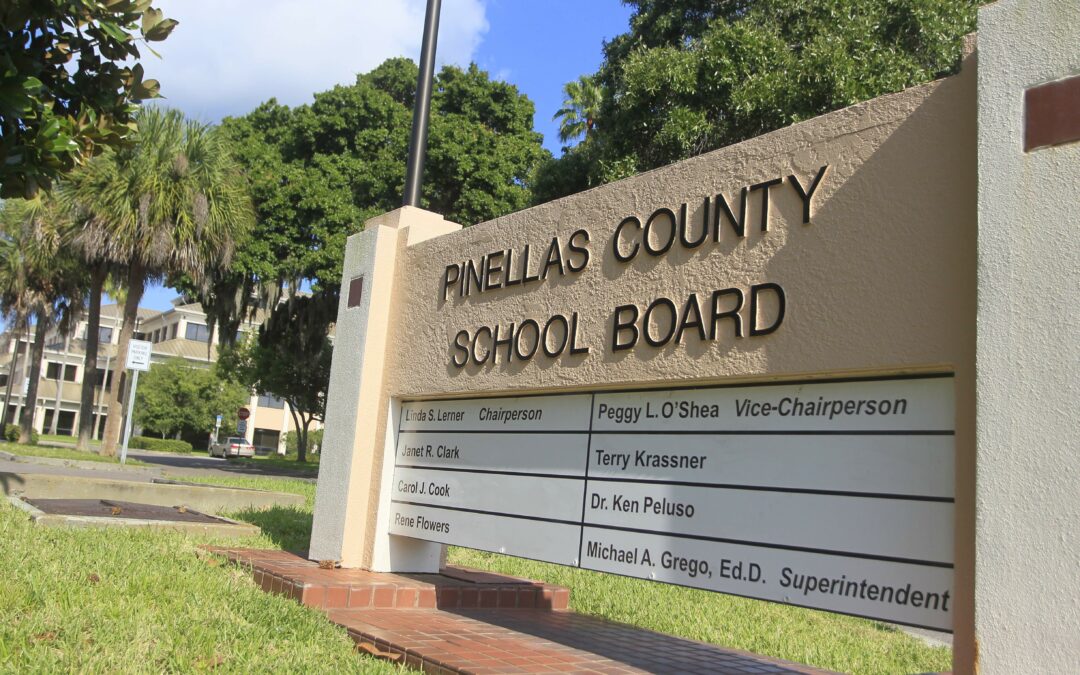

by Carol Lawson Esq | Jun 25, 2019 | Florida Foreclosures, Foreclosure

Locked out

Imagine this: you’re on a two-week vacation. You come back, and find a notice on your door: Entry by unauthorized persons prohibited.

Your key in the lock – it doesn’t fit. You peek through the windows and see that everything you left behind is gone – your furniture, your clothes, your photographs – everything.

You’ve been a victim of your mortgage.

Most mortgages that allows the bank to “protect its interest” in the “security” pledged for the loan – in other words, your home. If the bank, or its inspectors, decide at any point that you’ve “abandoned” the home, they claim the mortgage gives them the right to change the locks, board the windows, drain the pipes, and clean out any trash- your stuff.

Here’s the language most commonly used in many Florida mortgages:

9. Protection of Lender’s Interest in the Property and Rights Under this Security

Instrument. If (a) Borrower fails to perform the covenants and agreements contained in this Security Instrument, (b) there is a legal proceeding that might significantly affect Lender’s interest in the Property and/or rights under this Security Instrument (such as a proceeding in bankruptcy, probate, for condemnation or forfeiture, for enforcement of a lien which may attain priority over this Security Instrument or to enforce laws or regulations), or (c) Borrower has abandoned the Property, then Lender may do and pay for whatever is reasonable or appropriate to protect Lender’s interest in the Property and rights under this Security Instrument, including protecting and/or assessing the value of the Property, and securing and/or repairing the Property.

…

Securing the Property includes, but is not limited to, entering the Property to make repairs, change locks, replace or board up doors and windows, drain water from pipes, eliminate building or other code violations or dangerous conditions, and have utilities turned on or off. Although Lender may take action under this Section 9, Lender does not have to do so and is not under any duty or obligation to do so. It is agreed that Lender incurs no liability for not taking any or all actions authorized under this Section 9.

What does this mean? It means that the bank decides you’ve “abandoned” your home they can come in and take complete possession of your home, without foreclosing or even giving you prior notice.

The police will not help you- they will tell you it is a civil matter to higher an attorney.

Clearwater Bankruptcy, 28870 U.S. Hwy 19 #361, Hodusa Towers, Clearwater, FL 33761,

Phone: (727) 330-1627 email: carollawsonesq@gmail.com

by Carol Lawson Esq | Jun 3, 2019 | Bankruptcy, Florida Foreclosures, Loan Modification

In re Valone, — F.3d —-, 2015 WL 1918138 (11th Cir. 2015).

Chapter 13 bankruptcy debtors who do not claim the homestead exemption may instead choose the “wildcard” exemption” under Florida Statute section 222.25(4) even if they protect their home through the use of the Chapter 13 bankruptcy process.

Clearwater Bankruptcy, 28870 U.S. Hwy 19 #361, Hodusa Towers, Clearwater, FL 33761,

Phone: (727) 330-1627 email: carollawsonesq@gmail.com

by Carol Lawson Esq | Jun 2, 2019 | Bankruptcy, Consumer Credit, Florida Foreclosures

If you fail to pay your credit cards, medical bills, have a foreclosure, or car repossession they can sue you for the balance owed. This will normally result in a judgment against you. Judgments are then recorded with the Clerk of Court in the county in which they were an issue.

What you need to know.

How long is the judgment good for?

Lien of Judgment under FSA §55.081 is good for 20 years.

Actions on non-recorded judgments under FSA §95.11(2)(a) are good for 5 years.

Mechanic Lien judgments under FSA §95.11(5)(b) are good for 1 year.

Judgments of Foreclosure where a deficiency is reserved on must have the action on the deficiency filed within 1 year from the foreclosure judgment. FSA §95.11(2)(c)

Many judgments can be re-recorded for an additional 10 years.

The Judgment will appear on your credit report.

Once a judgment is filed against you it will show under public records on your credit report. This is information that is pulled by the credit bureaus through various services. The majority of unsatisfied judgments will sit on your credit report for 7-10 years from the date the judgment is filed by the court. This will have a major derogatory impact on your credit score.

If the judgment is re-recorded before the 7 year period runs, it can appear for an additional 7-10 years on your credit report from the new recording date.

Satisfied Judgments

If you pay a judgment you will receive a notice of Satisfaction from the lender. You need to record this with the Clerk of Court. Some lenders will record these, but many will not. Once the Satisfaction is recorded with the Clerk of Court the next time the credit bureaus pull your public records they will be notified of the update. You can also send a letter of dispute on your credit report with a copy of the recorded satisfaction. This will not result in the removal of the judgment from your credit report, but you can have it noted in consumer comments.

Vacated Judgments

Vacated judgments can be removed from your credit report. Send a copy of the order Vacating the judgment to the credit bureau.

Some mortgage lenders will require judgments to be paid off in order to close on a mortgage depending on your credit.

Credit reports contain inaccurate or missing information about 1/4 of the time. You should check your credit report for each agency on a yearly and follow up on anything that needs to be disputed. You can pull a free credit report here: https://www.annualcreditreport.com/index.action It is best to only pull one report every 4 months so you have a constant snapshot, unless you find an error.

Judgments and Bankruptcy

The underlying debt if disclosed to your attorney, or on your credit report, will be included in your bankruptcy. This means you will no longer be liable under the judgment once your bankruptcy is discharged. However, this does not remove the judgment lien. Additional action, which incurs additional attorney fees in needed.

This action is a Motion To Avoid A Judicial Lien, the typical charge is $400.00 and it is filed during your bankruptcy case. The Order is then filed and recorded in your State Court Action, thereby releasing the lien. These judgments can then be removed from your credit report.

Related Articles:

http://carollawsonpa.com/how-long-does-it-stay-on-my-credit/

Unpaid Debt and the Statute of Limitations

Debt Collection Calls

Debt Collector’s Calling?

Time Barred Debt in Chapter 13

http://carollawsonpa.com/fair-debt-collection-act-and-offer-of-settlement/

Clearwater Bankruptcy, 28870 U.S. Hwy 19 #361, Hodusa Towers, Clearwater, FL 33761,

Phone: (727) 330-1627 email: carollawsonesq@gmail.com

by Carol Lawson Esq | Oct 24, 2015 | Florida Foreclosures, Foreclosure, Uncategorized

5th DCA State of Florida held that trial court erred in granting a mortgagee’s motion for summary judgment when the plaintiff failed to provide an authenticated notice of acceleration.

http://www.5dca.org/Opinions/Opin2015/020215/5D14-1191.op.pdf

Clearwater Bankruptcy, 28870 U.S. Hwy 19 #300, Hodusa Towers, Clearwater, FL 33761,

Phone: (727) 330-1627 email: calh@gate.net