by Carol Lawson Esq | Oct 11, 2019 | Bankruptcy, Consumer Credit, Florida Foreclosures, Foreclosure

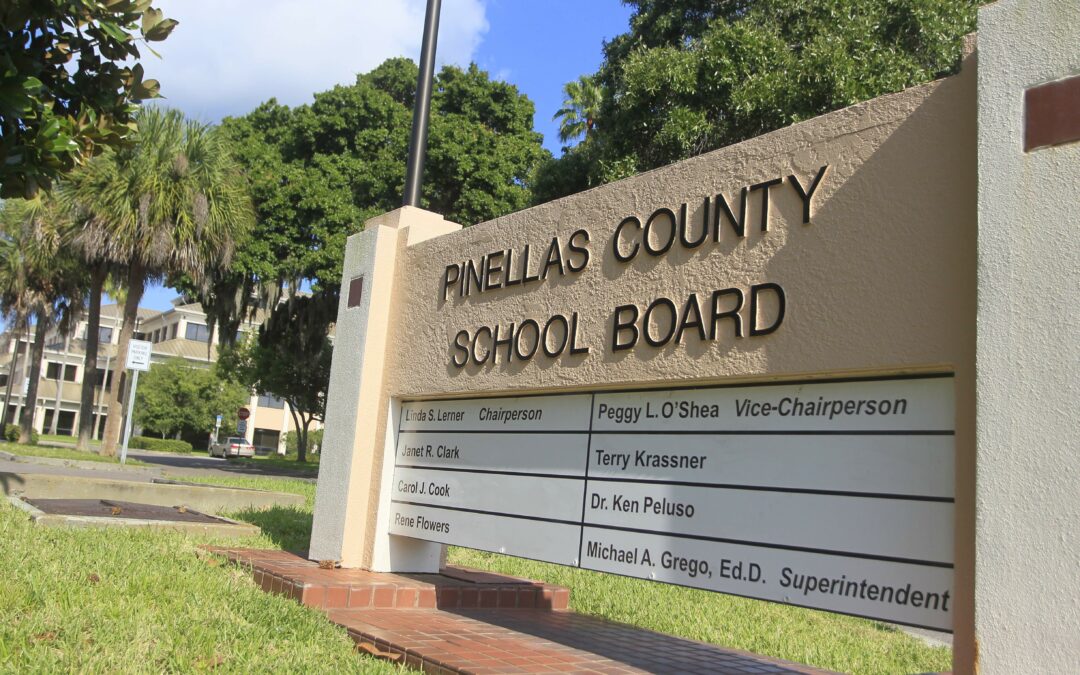

Teachers and staff did you know that you have the MetLife Plan through Hyatt Legal you can

receive - a free trust, will, quitclaim deed, living will, healthcare surrogate, and DPOA

before the end of the year.

If they you my office - Carol Lawson PA- #727-410-2705, not only are after school appointments

available, but you receive a Dementia Directive for free.

Hyatt will also pay the Attorney fees ( no costs) for a Bankruptcy. Our office participates

in this area handling Chapter 7s only. Costs by our office are credit report, personal property

apprassial, and filing fee. You also are responsible for a credit counseling class.

by Carol Lawson Esq | Jun 25, 2019 | Florida Foreclosures, Foreclosure

Locked out

Imagine this: you’re on a two-week vacation. You come back, and find a notice on your door: Entry by unauthorized persons prohibited.

Your key in the lock – it doesn’t fit. You peek through the windows and see that everything you left behind is gone – your furniture, your clothes, your photographs – everything.

You’ve been a victim of your mortgage.

Most mortgages that allows the bank to “protect its interest” in the “security” pledged for the loan – in other words, your home. If the bank, or its inspectors, decide at any point that you’ve “abandoned” the home, they claim the mortgage gives them the right to change the locks, board the windows, drain the pipes, and clean out any trash- your stuff.

Here’s the language most commonly used in many Florida mortgages:

9. Protection of Lender’s Interest in the Property and Rights Under this Security

Instrument. If (a) Borrower fails to perform the covenants and agreements contained in this Security Instrument, (b) there is a legal proceeding that might significantly affect Lender’s interest in the Property and/or rights under this Security Instrument (such as a proceeding in bankruptcy, probate, for condemnation or forfeiture, for enforcement of a lien which may attain priority over this Security Instrument or to enforce laws or regulations), or (c) Borrower has abandoned the Property, then Lender may do and pay for whatever is reasonable or appropriate to protect Lender’s interest in the Property and rights under this Security Instrument, including protecting and/or assessing the value of the Property, and securing and/or repairing the Property.

…

Securing the Property includes, but is not limited to, entering the Property to make repairs, change locks, replace or board up doors and windows, drain water from pipes, eliminate building or other code violations or dangerous conditions, and have utilities turned on or off. Although Lender may take action under this Section 9, Lender does not have to do so and is not under any duty or obligation to do so. It is agreed that Lender incurs no liability for not taking any or all actions authorized under this Section 9.

What does this mean? It means that the bank decides you’ve “abandoned” your home they can come in and take complete possession of your home, without foreclosing or even giving you prior notice.

The police will not help you- they will tell you it is a civil matter to higher an attorney.

Clearwater Bankruptcy, 28870 U.S. Hwy 19 #361, Hodusa Towers, Clearwater, FL 33761,

Phone: (727) 330-1627 email: carollawsonesq@gmail.com

by Carol Lawson Esq | Oct 24, 2015 | Florida Foreclosures, Foreclosure, Uncategorized

5th DCA State of Florida held that trial court erred in granting a mortgagee’s motion for summary judgment when the plaintiff failed to provide an authenticated notice of acceleration.

http://www.5dca.org/Opinions/Opin2015/020215/5D14-1191.op.pdf

Clearwater Bankruptcy, 28870 U.S. Hwy 19 #300, Hodusa Towers, Clearwater, FL 33761,

Phone: (727) 330-1627 email: calh@gate.net

by Carol Lawson Esq | Oct 24, 2015 | Consumer Credit, Florida Foreclosures, Foreclosure

3rd DCA Florida reversed a final summary judgment of foreclosure terminating constructions liens of the developer.

https://scholar.google.com/scholar_case?case=14261552780645400537&q=CDC+Builders,+Inc.+v+Biltmore&hl=en&as_sdt=40006

Clearwater Bankruptcy, 28870 U.S. Hwy 19 #300, Hodusa Towers, Clearwater, FL 33761,

Phone: (727) 330-1627 email: calh@gate.net

by Carol Lawson Esq | Jul 23, 2015 | Consumer Credit, Florida Foreclosures, Foreclosure

I just wrote a blog on Note Worthy Foreclosure Case for July in Florida check it out at

http://carollawsonpa.com/note-worthy-foreclosure-cases-in-florida-july-2015/

Clearwater Bankruptcy, 28870 U.S. Hwy 19 #300, Hodusa Towers, Clearwater, FL 33761,

Phone: (727) 330-1627 email: calh@gate.net

by Carol Lawson Esq | Jul 2, 2015 | Florida Foreclosures, Foreclosure

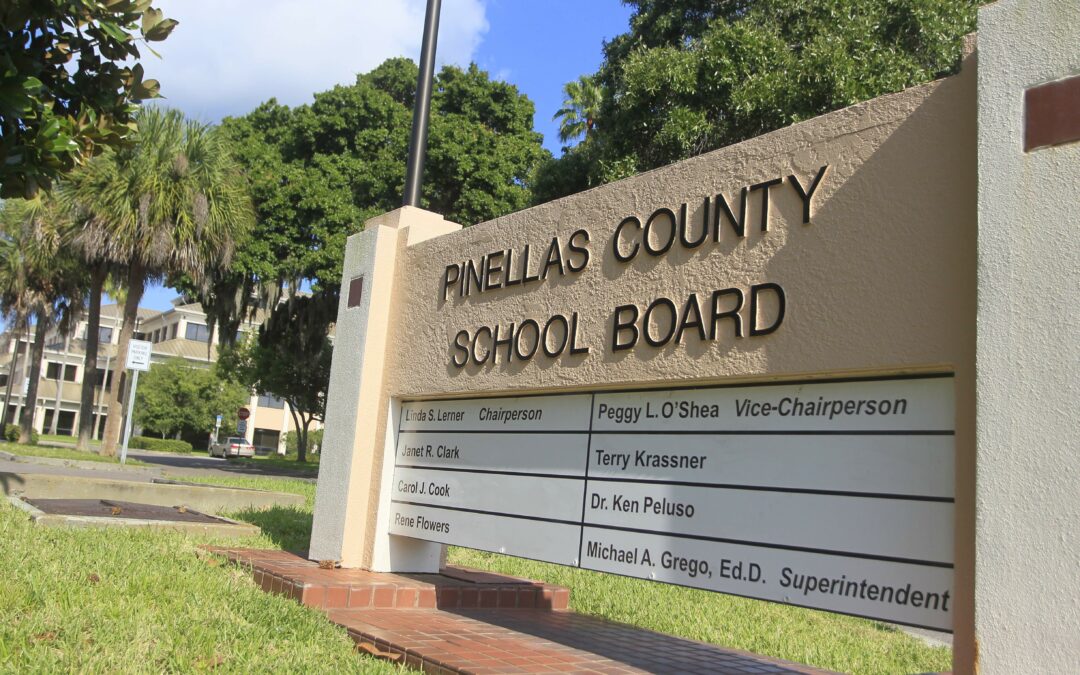

I don’t know about you, but, I’m seeing a trend and it is not good for the consumer. First the 4th DCA, then the 5th DCA and now the 2nd DCA rule Prior Servicer’s Records Admissible On Testimony By Subsequent Servicer. I wonder do any of these Judges know that the Creditor law firms have direct access to the payment history and can go in and manipulate charges and how the money is applied? These banks changes servicers and law firms constantly- do you have any idea how many people have touched your loan history? I don’t.

The latest case is AS Lily LLC v. Harold Morgan it was appealed from Judge Campbell in Pinellas County by The Solomon Law Firm on behalf of AS Lily. The 2nd DCA found that incorporation or adoption of prior servicer’s records was allowed if the servicer verified them before using them as his own. WAMCO XXVII, Ltd. V. Integrated Electronic Environments, Inc., 902 So. 2d 230 (Fla. 2d DCA 2005).

Judge Campbell had relied on Glarum v. LaSalle Bank Natl. Ass’n, 83 So. 3d 780 (Fla. 4th DCA 2011).

http://www.2dca.org/opinions/Opinion_Pages/Opinion_Pages_2015/May/May%2008,%202015/2D14-863.pdf

Clearwater Bankruptcy, 28870 U.S. Hwy 19 #300, Hodusa Towers, Clearwater, FL 33761,

Phone: (727) 330-1627 email: calh@gate.net